Employment Data Suggest Fed Could Be "Patient" Until 2016—or Later

More on:

In its last two statements, the FOMC has said that it “expects inflation to rise gradually toward 2 percent over the medium term”—2 percent being its target rate. What would it take to move it there?

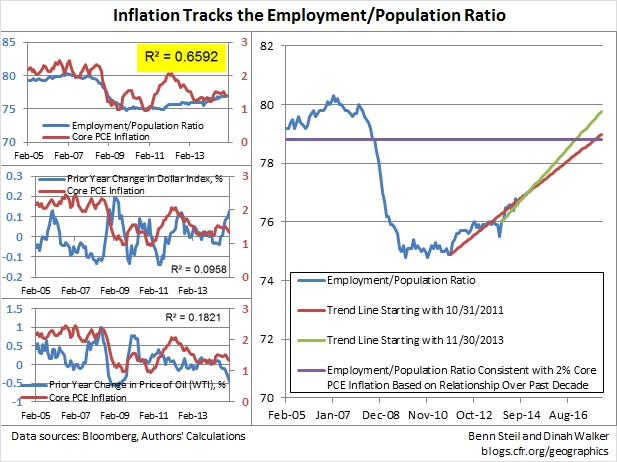

We looked at how many different variables correlate with the Fed’s preferred inflation measure—core PCE inflation. Oil and the dollar have been much in the news of late, but their prices have had little relationship with core PCE inflation over the past decade, as shown in the bottom-left figures above. The single variable that seems to correlate best, as seen in the top-left figure, is the employment/population ratio among adults aged 25-54 years. If we follow this ratio’s trend-line since 2013, when it began its last major upturn, this suggests that core PCE inflation won’t hit 2% until late 2016 or early 2017—as seen in the large right-hand figure. If we follow it since its trough in 2011, core PCE inflation does not hit 2% until late 2017.

This suggests that a “patient” Fed might not begin hiking rates until considerably later than the market is currently anticipating, which is the middle of this year. A 2016 rise seems more plausible.

The Economist: Opportunistic Overheating

Wall Street Journal: Fed Flags Midyear Rate Hike-Or Later

Financial Times: Dollar Rally Stalls on Rate Rise Rethink

Federal Reserve: FOMC January 28, 2015 Statement

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store