Global Economics Monthly: October 2015

A (Chinese) River Runs Through It

October 9, 2015

- Report

Bottom Line: Experts disagree about whether China faces a hard landing, but emerging markets pose a growing risk to the global recovery.

Two months ago, a seemingly innocuous change in the way China sets the value of its currency—opening the market each day at a rate related to the closing rate the day before—rattled global markets. Since that time, the renminbi (RMB) has weakened further against the U.S. dollar, then strengthened after strong government support, and now stands just 2.5 percent lower than it was on August 11. Global stock markets, in contrast, have experienced bigger changes: the Dow Jones Industrial Average and the Shanghai Composite Index are down by 6.5 percent and 22 percent respectively, compared to the day of RMB devaluation.

The crisis reflects long-standing concerns about the Chinese economy, including overinvestment and excess capacity in manufacturing, real estate and stock market bubbles fueled by easy money and leverage, and an incomplete reform process that failed to place hard budget constraints on state enterprises. In addition, the initial policy response by the government was chaotic and opaque. Together, those predicting a hard landing have good reason to suspect that the crisis has more room to run.

China's Growth Story

More on:

In a somewhat surprising announcement this week, the International Monetary Fund (IMF) reaffirmed its China growth forecast at 6.8 percent this year and 6.3 percent in 2016, below the official government forecast of 7 percent but well above many market projections. Such optimism relies on three basic tenets. First, the nearly double-digit growth of services and retail sales will continue, providing evidence that the much-discussed rebalancing of the Chinese economy is indeed underway. Second, policy will be better coordinated and communicated going forward and monetary and fiscal stimulus will provide meaningful support to activity later this year. Third, the sharp slowdown in manufacturing will not cascade to the broader economy. Stabilization in China is a central pillar of an IMF global outlook that, while marked down from earlier forecasts, is still the highest it has been since 2011.

Most likely, the truth in China lies somewhere between hard-landing and muddle-through scenarios. Chinese growth tends to be smoothed, underreporting activity in a boom and overreporting it in a downturn. Other indicators of growth, including sales, energy consumption, and cross-border shipments, also tell a mixed story. Many forecasters have marked down their China forecast by half to three-quarters of a percentage point. But ultimately, how Chinese policymakers respond will likely be determinative to the path Beijing takes.

Emerging Risks

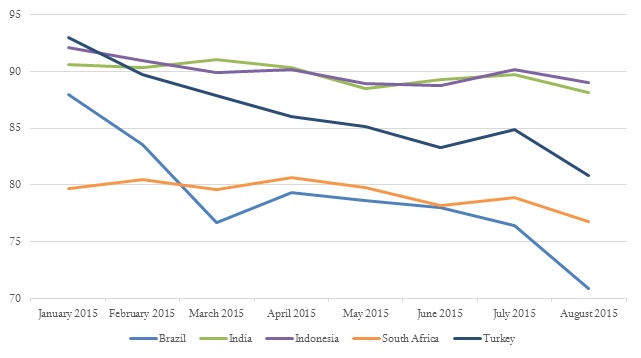

Of course, strong growth in Chinese services and a jobs-supporting Chinese government stimulus package are small comfort to a commodity-exporting emerging country and its companies. The direct effect of a China manufacturing bust on the major commodity exporters—notably Australia, Brazil, and Argentina—is already being felt strongly and is likely to put increasing pressure on these governments. In countries where policies have been weak, markets have been brutal in their response. In Brazil, which is also experiencing a political crisis, the real is down 30 percent against the U.S. dollar since July, and the Sao Paolo Bovespa index is down by 10 percent. Other countries, such as South Africa and Indonesia, also face significant currency pressures.

However, perhaps the greater risks come from financial contagion. A number of recent reports (for example, the IMF’s Global Financial Stability Report and an Institute of International Finance report) have highlighted the rapid buildup in corporate debt, with the Bank for International Settlements (BIS) warning of a looming banking crisis as a result of rapid credit growth in some emerging markets.

More on:

According to the Institute of International Finance, emerging market nonbank corporate debt has increased 500 percent over the past decade, to $23.7 trillion or around 90 percent of gross domestic product (GDP) of these countries. Corporate debt defaults weigh directly on economic growth and can damage the balance sheets of banks that have lent to those companies and the countries that stand behind the banks. Much of this debt is linked to trade with China and falling profits, as well as losses that could result from added currency volatility, which is likely to dramatically add to the burden of servicing this debt. This could create financial distress throughout the emerging world and add to deflationary pressures, which in turn would depress returns on investment. Indeed, some are concerned that the loss of trust between tightly connected financial institutions could contribute to a deleveraging and pullback in activity akin to what happened in 2008.

On top of these cyclical concerns, the most striking change in the IMF’s outlook is a sharp downward revision to the long-term growth prospects for emerging markets. The end of the commodity cycle, and a reversal of capital inflows, signals a period of lower investment and weaker fiscal positions, and as a result policymakers in many cases have reduced capacity to support growth. In many cases, the optimism that existed following the Great Recession that emerging market countries would rapidly see their incomes converge to levels in industrial countries has been lost.

For the United States in particular, fragility in emerging markets is the critical risk. By itself, softer Chinese growth and the 2.5 percent decline in the RMB since August 11 would only reduce U.S. growth by 0.1 or 0.2 percent. There is an additional argument that the RMB’s exchange-rate movement has a smaller effect on the U.S. economy than in the past, reflecting the globalization of supply chains and the continuing small role that trade plays in the U.S. economy compared with China’s other major trading partners. Still, exchange-rate pass-through can take time to play out—as much as two years—and the U.S. economy continues to absorb the effects of last year’s appreciation against the euro and yen. If other countries depreciate their own currencies against the dollar in response to these pressures, the effect of the broader appreciation of the dollar against a trade-weighted average of our trading partners could be significant. (A rough rule of thumb is that a 10 percent move in the trade-weighted dollar reduces U.S. GDP by around half a percentage point after a year.)

FIGURE 1. CURRENCY DEPRECIATION IN EMERGING MARKETS

These risks appear to have been an important factor in the September decision by the Federal Reserve to delay raising interest rates from zero. As Fed Chair Janet Yellen noted in her press conference, concerns about an abrupt slowdown in China (and emerging markets more generally), along with commodity price declines and an appreciation of the dollar, provided a deflationary shock that was cause for concern. Although deflationary pressures were expected to be temporary, these moves contributed to a tightening of financial conditions that may have tipped the scales toward delaying a raise. The challenge for the Fed is that these pressures are unlikely to resolve and the path forward will not be any clearer the next time the Fed meets. In sum, the China-driven emerging markets risks are likely to dominate decision-making for months if not years to come.

Looking Ahead: Kahn's take on the news on the horizon

United States

The Treasury exhausts its borrowing authority on November 5, and some analysts place odds of a government shutdown in December as high as 50 percent.

Europe

Greek debt relief negotiations should start soon; if protracted, the situation could renew concerns about “Grexit.”

Central banks

The European Central Bank (ECB) and Bank of Japan may both consider new easing measures, but new dollar strength could push the market back.

Online Store

Online Store