- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Introduction There is a serious risk of extremist violence around the 2024 U.S. presidential election. Many of the same sources of instability and grievances that precipitated the January 6, 2021,…Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

April 5, 2012

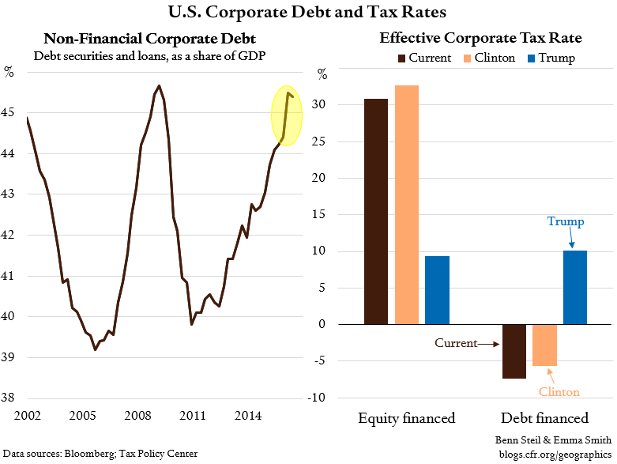

Corporate GovernanceThe United States has not had a comprehensive overhaul of its tax code since the 1986 Tax Reform Act signed into law by President Reagan. Nearly twenty-six years and over 15,000 special tax provision…

November 13, 2019

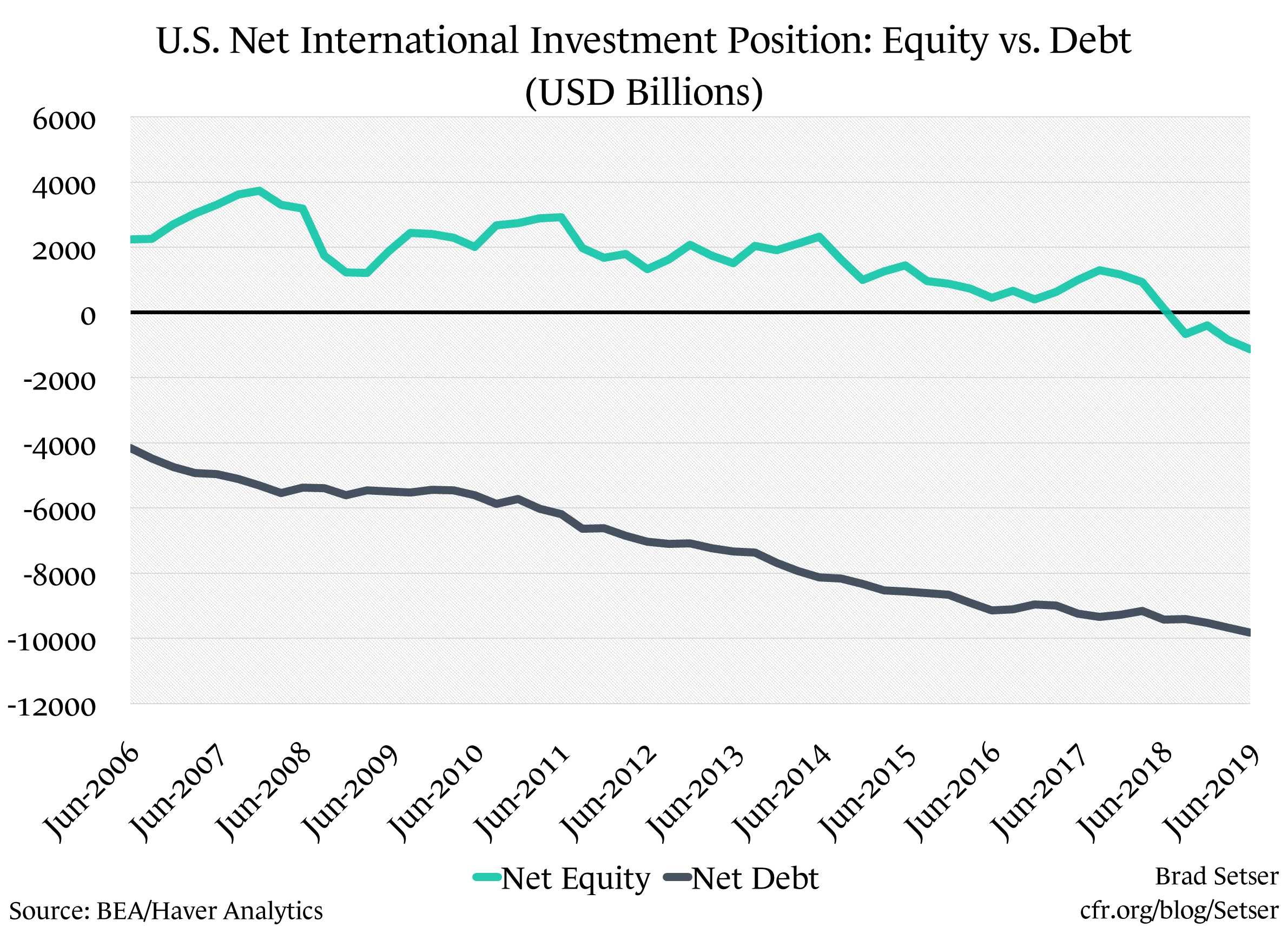

United StatesMost grandiose explanations for the United States' persistent surplus in the income balance of the U.S. current account miss the mark. The U.S. debt position tracks the sum of past current account de…

September 16, 2014

Corporate GovernanceWashington policymakers can be forgiven for focusing on the low-hanging fruit when it comes to corporate tax reform. When Congress hasn’t managed any kind of major reform since 1986, we should probab…

February 25, 2022

United StatesMomentum for the landmark global minimum tax agreement adopted last fall has stalled. Countries risk losing the best opportunity in decades at international corporate taxation reform if they do not p…

Online Store

Online Store