- RealEcon

- Israel-Hamas

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedFollowing a long series of catastrophic misadventures in the Middle East over the last two decades, the American foreign policy community has tried to understand what went wrong. After weighing the e…

Book by Steven A. Cook June 3, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

February 19, 2019

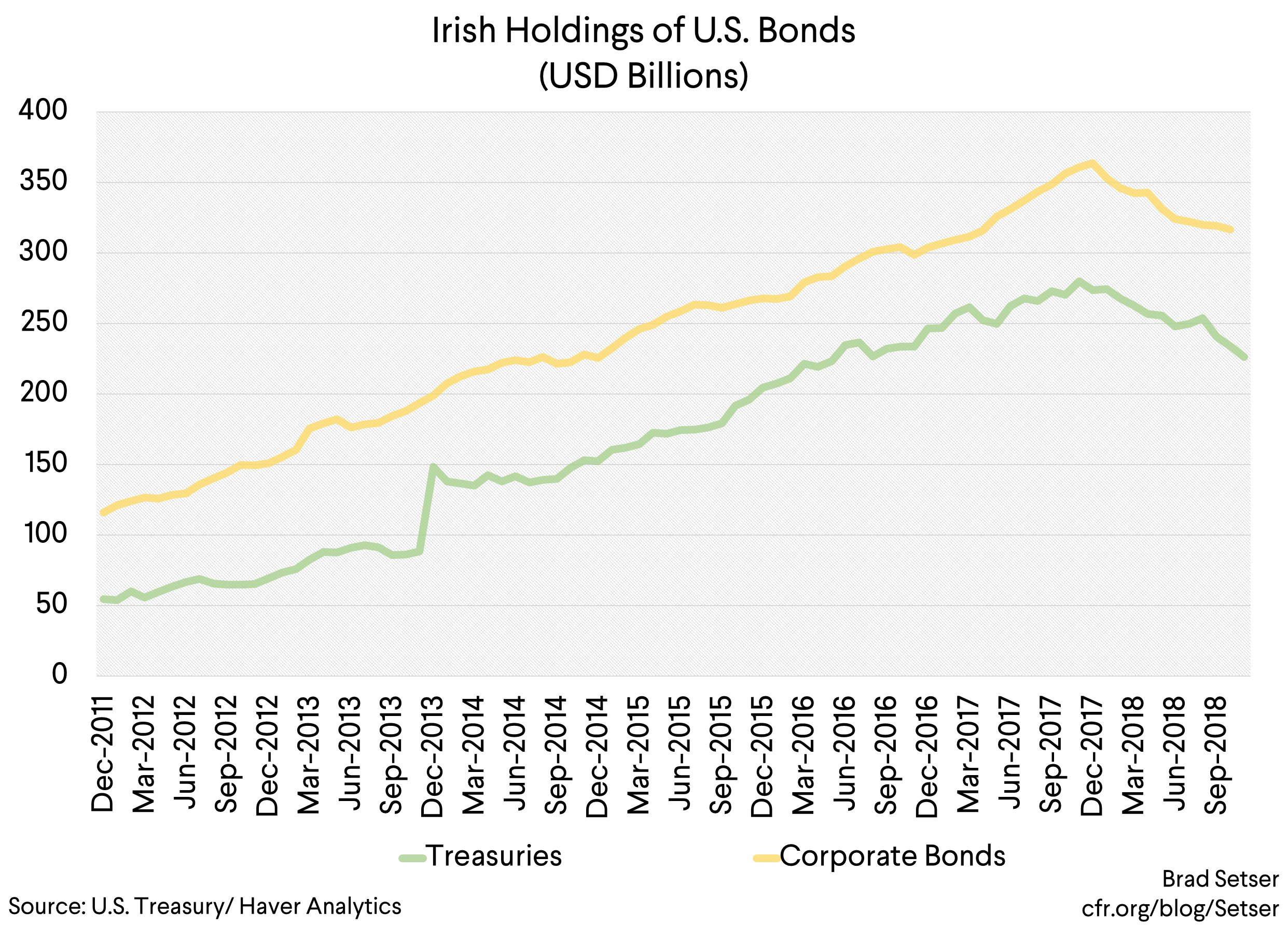

IrelandI wanted to follow up on a few points that I didn’t have space to explore in my New York Times op-ed on the international provisions of Trump’s corporate tax reform. The first is that, well, there…

July 3, 2019

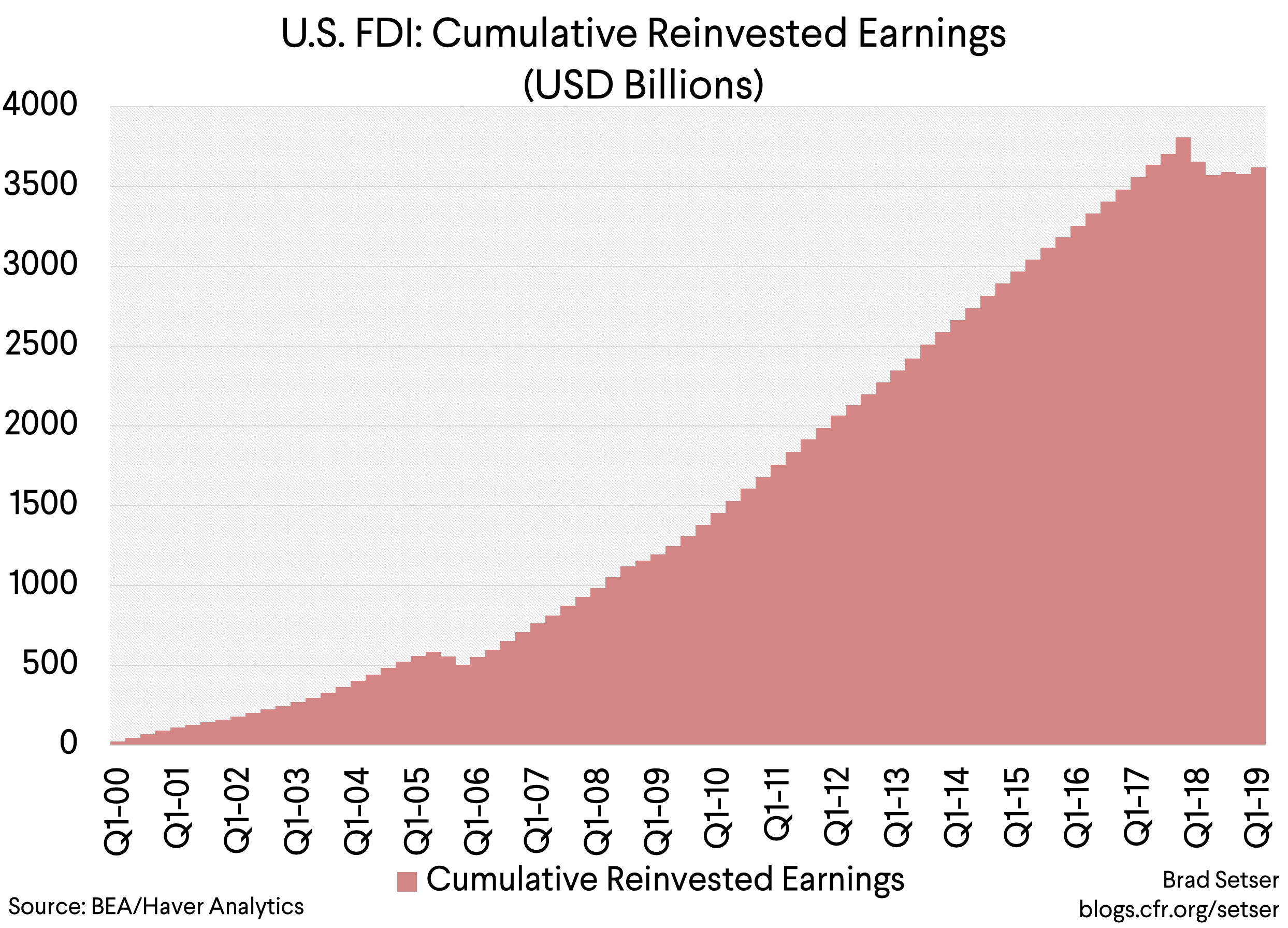

United StatesThe international side of the Tax Cuts and Jobs Act was a real reform, not just a straight-forward cut in the rate. It ended deferral, and shifted to a (mostly) territorial tax system. Yet, judging f…

January 5, 2018

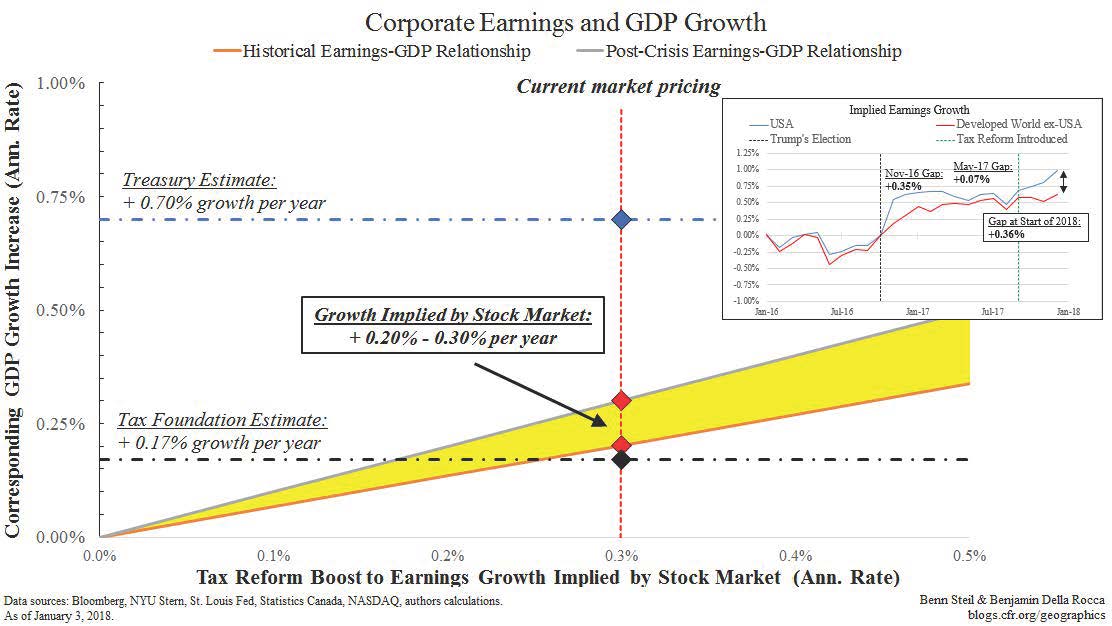

United StatesIn Foreign Affairs online last month, we used our own implied earnings growth (IEG) estimates from stock prices around the world to evaluate President Trump’s impact on the U.S. market. We found …

June 29, 2018

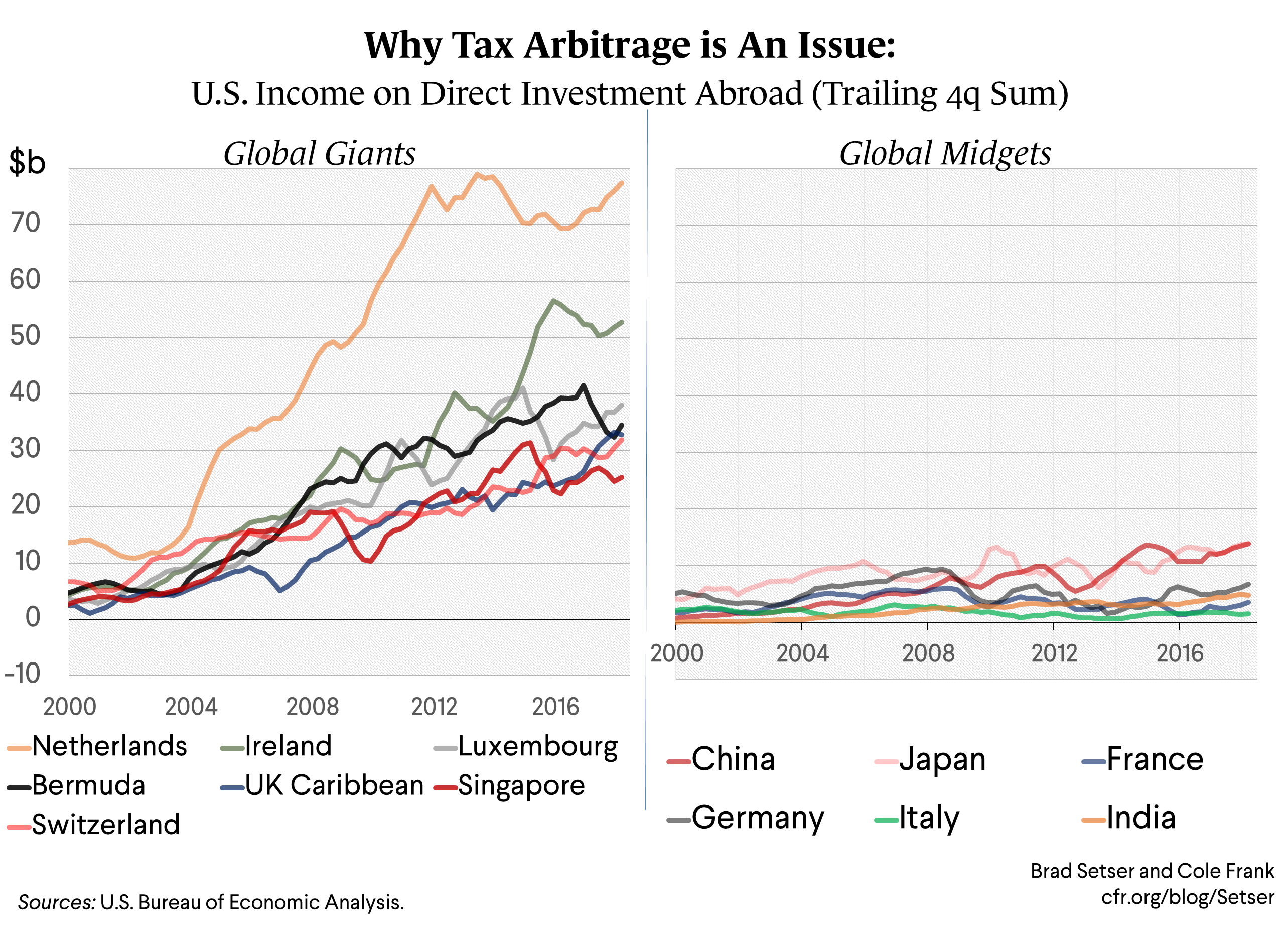

United StatesThe impact of the U.S. tax reform on the U.S. trade balance was a hot item of debate last December. There was an argument that reducing the headline tax rate—and creating an even lower tax for the…

February 25, 2022

United StatesMomentum for the landmark global minimum tax agreement adopted last fall has stalled. Countries risk losing the best opportunity in decades at international corporate taxation reform if they do not p…

Online Store

Online Store