Yes Virginia, there was an international financial crisis in 2007 and 2008

More on:

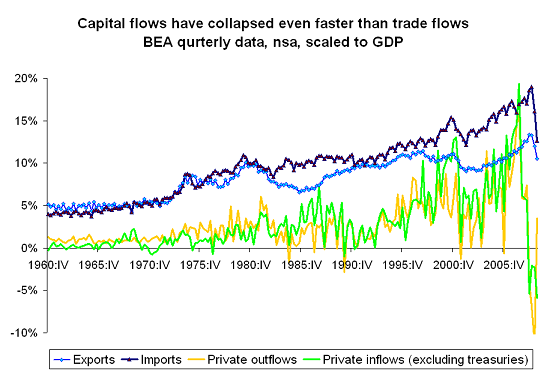

Now that the markets have lost a bit of their froth, it seems fitting to note just how sharply trade -- and private financial flows -- have contracted over the past year. The US q1 balance of payments data is rather stunning.

Trade (as we all know) contracted far more rapidly during this cycle than in the past.

But the fall in private financial flows -- outflows as well as inflows -- has been even sharper than the fall in trade flows. US private investment in the rest of the world rebounded a bit in the first quarter, but private demand for US financial assets remained in the doldrums. Private investors were still pulling funds out of the US in the first quarter.

A close examination of the graph indicates that demand for US financial assets by private investors abroad actually peaked in the second quarter of 2007 --- a peak that came after gross private flows (inflows as well as outflows) rose strongly in 2005 and 2006. That surge was -- in my view -- linked to the chain of risk associated with a world where central banks took the currency risk associated with financing the US external deficit and private intermediaries took the credit risk associated with financing ever more indebted US households.

Any interpretation of what caused the crisis has to explain this surge. But any interpretation of the crisis also needs to explain why US imports and exports continued to rise -- and the US trade and current account deficit remained large -- even after private inflows collapsed.

I suspect that part of the answer is that a lot of private inflows were linked to private outflows -- as special investment vehicles operating in say the US could only buy long-term US mortgage bonds if someone in the US bought their short-term paper. The fact that private outflows collapsed along with private inflows meant that net private flows didn’t fall at the same rate. Indeed, at times - notably in q4 2008 -- the fact that US investors pulled funds out of the rest of the world faster than foreign investors pulled funds out of the US provided the US with a significant amount of net financing.

And part of the answer is that private investors never were the only source of financing for the US current account deficit. Strong central bank demand -- especially in late 2007 and early 2008 -- offset a fall in private flows.

One thing though is sure: the scale of the collapse in private financial flows during this crisis is entirely unprecedented. There were a few instances in the past when private flows (excluding flows into Treasuries) were slightly negative. But outflows of 5% of GDP in a quarter are entirely unprecedented. And now that the US data has been revised to reflect the survey, adding private purchases of Treasuries back in doesn’t change all that much ...

Net private demand for long-term US financial assets - that is purchases of US securities and foreign direct investment in the US, net of US purchases of foreign securities and US direct investment abroad -- has been weak for some time now.

There is more to say on the details of the balance of payments data, but I’ll live it for another post.

More on:

Online Store

Online Store